Global Stock Radar: April 2025

Five under the radar companies from around the world that grabbed our interest

Welcome to my Substack, where I delve into the world of truly undiscovered companies from across the globe. Everyone is talking about the same 200-300 stocks, but there are more than 55,000 publicly traded companies in the world. Here, we explore hidden gems in the financial markets that often fly under the radar of mainstream analysts and investors.

Global Stock Radar (April 2025)

1. 🇸🇪 Röko AB (STO: ROKO.B)

A Nordic Platform Quietly Compounding Niche Growth

Röko is a Sweden-based holding company acquiring and scaling profitable niche businesses across Europe. Since 2019, it has grown into a 28-company group via a permanent ownership model, decentralizing operations while centralizing discipline. Now publicly listed, it offers rare visibility into one of the region’s more compelling long-term compounders.

Key Metrics:

Revenue (2024): SEK 6.18B (+10%)

Adj. EBITA: SEK 1.23B (+17%)

EBITA Margin: 20%

Net Income: SEK 702M (+30%)

Net Debt / EBITDA: 0.2x

ROCE: 14.4%

5Y Revenue CAGR: ~157%

Why It’s Interesting:

Permanent capital model with no exits — rare in public markets

Healthy organic growth in comparable companies (2%)

Operates in fragmented, under-the-radar sectors with limited competition

Excellent margin discipline across both B2B and B2C units

Strong alignment with portfolio company leadership through co-ownership

Growth & Financials: Röko’s 2024 performance reflects steady expansion: 10% top-line growth, 17% EBITA growth, and consistent margin expansion. Organic growth in comparable businesses reached 2%, while five new acquisitions contributed to earnings momentum. The decentralized model keeps portfolio companies nimble, while Röko supports with capital, strategy, and governance.

Exhibit 1. Stock performance since IPO (from Finchat)

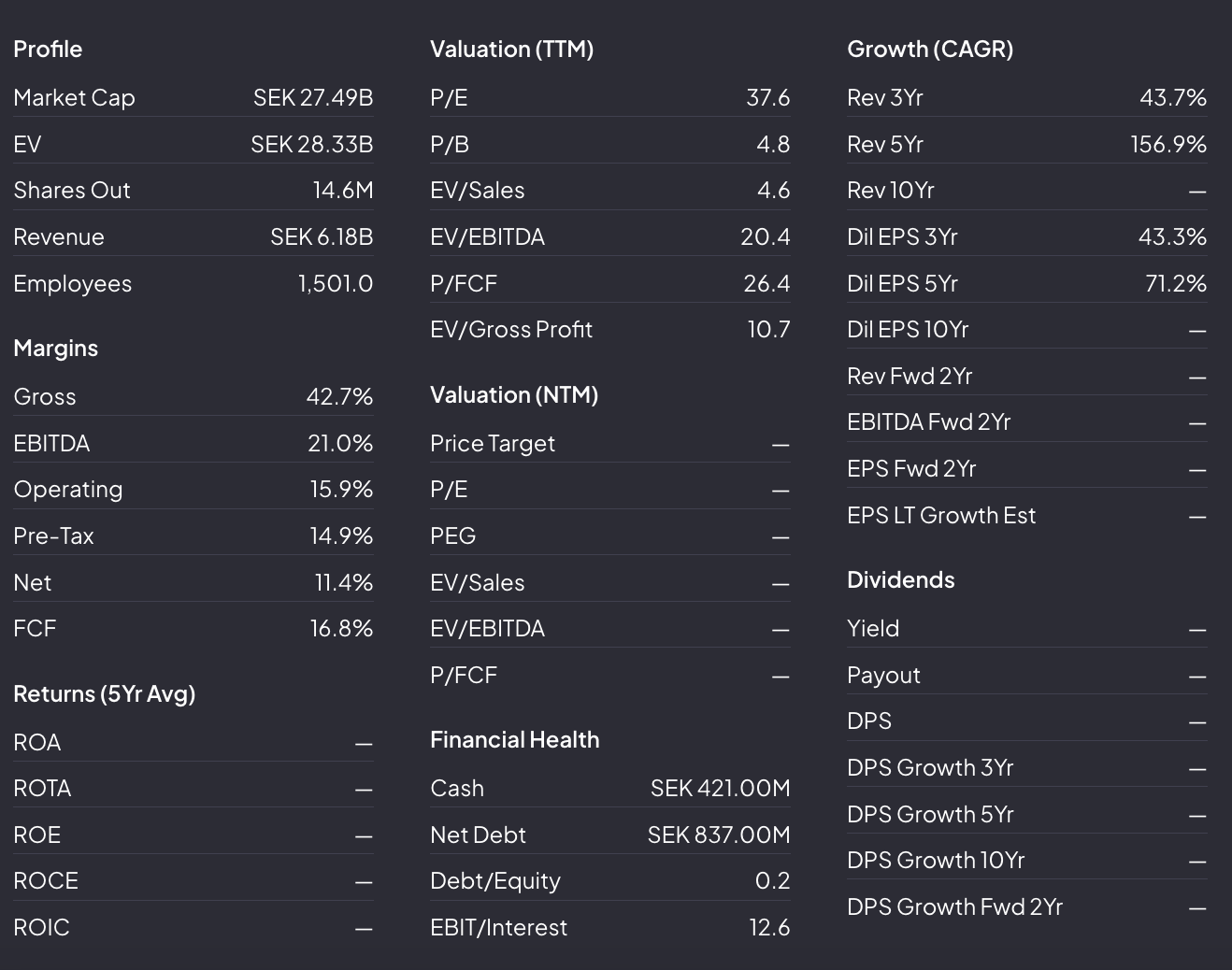

Valuation: At 37.6x earnings and 20.4x EV/EBITDA, Röko trades at a premium — but not without reason. Its track record of double-digit growth, asset-light model, and strong cash flow generation make it one of the more efficient listed acquirers in Europe. Its balance sheet remains underleveraged, giving it ample room to continue compounding.

Exhibit 2. Valuation metrics (from Finchat)

Why We’re Covering it: With its permanent capital model, long-term mindset, and operational restraint, Röko stands out as a disciplined European compounder. It’s early in its listed life but has laid the groundwork for years of measured, high-quality growth.