From Fragrance to Fashion: A Journey of Growth

How a Luxury Personal Care Brand with 75% Gross Margins Still Flies Under the Radar

Welcome to my Substack, where I delve into the world of truly undiscovered companies from across the globe. Everyone is talking about the same 200-300 stocks, but there are more than 55,000 publicly traded companies in the world. Here, we explore hidden gems in the financial markets that often fly under the radar of mainstream analysts and investors.

Teaser

A leader in the luxury personal care sector has shown impressive financial performance, driven by strategic brand management and consistent growth across its fragrance, fashion, make-up, and skincare segments. With a three-year revenue CAGR of 22.8% and a projected EBITDA growth of 8.2% over the next two years, the company is leveraging its diversified product portfolio to maintain profitability and market relevance. As it continues to expand internationally, its valuation metrics suggest a balanced outlook, offering potential for sustained growth.

Puig Brands SA: A Fragrance and Fashion Powerhouse with Growth Potential

Executive Summary

Puig Brands SA is a Spanish leader in the fragrance, fashion, and beauty industries

Revenue CAGR of 22.8% over the past three years, reflecting robust growth and strategic brand management.

Gross margin of 74.9% and EBITDA margin of 18.1%, indicating strong profitability.

Forward revenue growth of 7.3% over the next two years, driven by product diversification and global expansion.

EBITDA growth forecast of 8.2% over the next two years.

Cash position of €884.44 million with a manageable net debt of €1.17 billion.

Valuation metrics: Current P/E of 16.8x and forward P/E of 15.0x, indicating balanced market expectations.

Business at a Glance

Founded in 1914 by Antonio Puig Castelló, Puig Brands SA is a globally recognized leader in the fragrance, fashion, and beauty industries. The company, headquartered in Barcelona, Spain, has built a robust portfolio of well-known brands and continues to expand its presence in the luxury personal care market. As a private, family-owned company, Puig has managed to balance tradition with innovation, maintaining its heritage while embracing modern branding and global outreach.

Exhibit 1. Puig’s brands (from IR presentation or web page).

The company operates through three main segments: Fragrance and Fashion, Make-up, and Skincare. Its Fragrance and Fashion segment includes the creation, marketing, and sale of perfumes, clothing, accessories, and other fashion-related items. The Make-up segment offers a wide range of cosmetic products, while the Skincare segment provides solutions for cleansing, moisturizing, body care, sun care, and more. Puig's commitment to quality and innovation has allowed it to maintain a strong presence in the global market, catering to diverse consumer preferences.

Financial Performance

Puig has demonstrated consistent revenue growth, with a three-year compound annual growth rate (CAGR) of 22.8% and a five-year CAGR of 18.7%. The company's forward-looking estimates indicate revenue growth of 7.3% over the next two years, with an EBITDA growth projection of 8.2%. This growth trajectory has been driven by strategic brand management, product innovation, and geographic expansion.

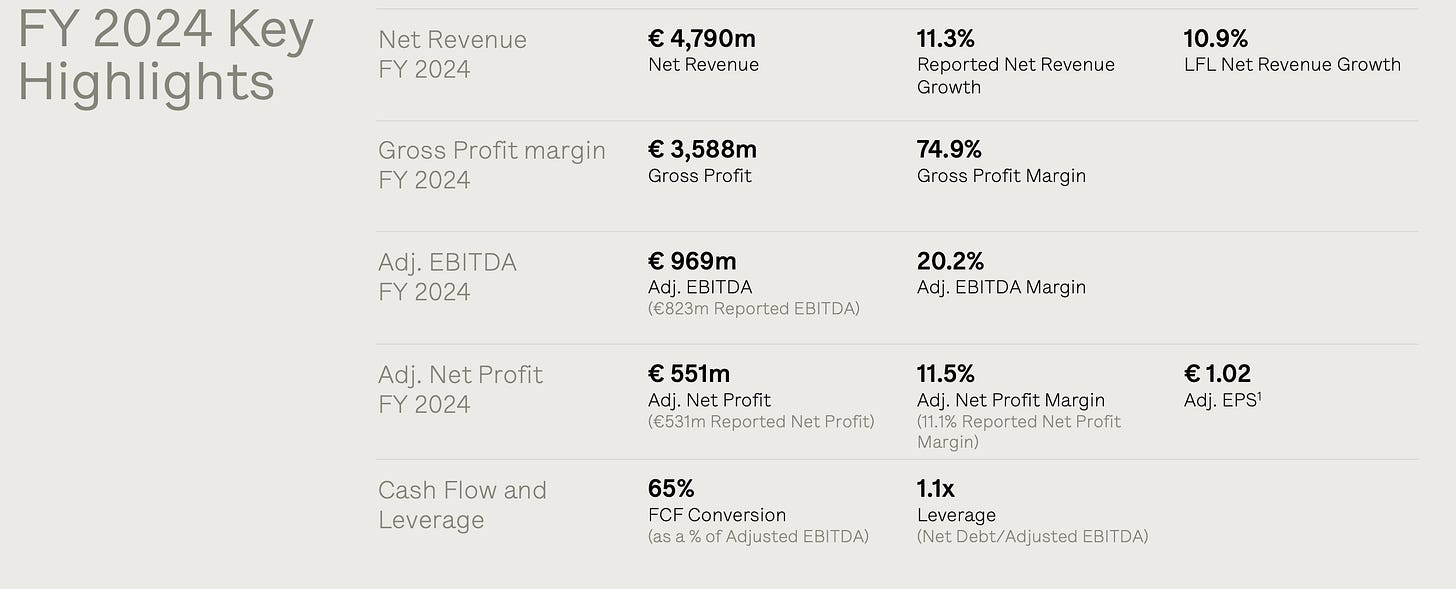

Exhibit 2. Puig’s financial performance in FY2024 (from IR presentation or web page).

Puig's margin profile is robust, reflecting efficient cost management and profitability. The company achieved a gross profit margin of 74.9%, demonstrating strong cost control and product pricing power. The EBITDA margin stands at 18.1%, while the operating margin is 15.6%, indicating effective operational efficiency. The net profit margin of 11.3% further underscores the company's ability to convert revenue into bottom-line earnings. These margins highlight Puig's balanced approach to scaling while preserving profitability.

Exhibit 3. Puig’s financial performance by revenue segment in FY2024 (from IR presentation or web page).

In addition to its solid revenue growth, Puig maintains a strong financial position with €884.44 million in cash and a net debt of €1.17 billion, reflecting prudent financial management. The company's free cash flow (FCF) stands at €620 million, resulting in an FCF yield of 6.6%. This reflects efficient operational management and the ability to generate cash while maintaining profitability.

Exhibit 4. Puig’s revenues by region in FY2024 (from IR presentation or web page).

Valuation Metrics

Puig Brands SA's valuation metrics indicate a company that is fairly valued within its sector. The current P/E ratio is 16.8x, while the forward P/E ratio is projected at 15.0x. The EV/EBITDA multiple currently stands at 11.1x, decreasing to 10.1x on a forward basis. Furthermore, the price-to-book (P/B) ratio of 2.6x and the EV/Gross Profit ratio of 2.9x suggest that the market has reasonably priced the company's growth prospects. The price target for Puig is set at €24.27 per share, indicating cautious optimism from analysts.

Exhibit 5. Puig’s outlook for 2025 (from IR presentation or web page).

The company's EV/Sales ratio stands at 2.4x, reflecting its ability to convert sales into enterprise value effectively. Additionally, the Price-to-Free Cash Flow (P/FCF) ratio of 16.9x demonstrates the market's confidence in Puig's ability to generate cash flow consistently. These valuation metrics reflect a balanced outlook, with the company positioned to benefit from both operational efficiency and brand strength.

Exhibit 5. Puig’s stock performance since the IPO in 2024 (Finchat).

Capital Allocation

Puig maintains a balanced approach to capital allocation, focusing on sustainable growth while maintaining financial flexibility. The company's return on equity (ROE) stands at 14.5%, while the return on invested capital (ROIC) is 11.2%. These figures indicate efficient use of shareholder capital and investment resources. Additionally, the return on assets (ROA) is 7.1%, reflecting the company's ability to generate profit relative to its asset base.

Capital expenditure (CapEx) has remained consistent at around 5% of revenue, primarily allocated to brand innovation and international expansion. This disciplined approach ensures that growth initiatives are adequately funded without over-leveraging the balance sheet. The company has also maintained a dividend payout ratio of 35%, reflecting a shareholder-friendly approach while reinvesting in growth opportunities.

Financial Health

Puig's financial stability is reinforced by a strong balance sheet, with total assets amounting to €6.1 billion, including €2.2 billion in intangible assets and €884.44 million in cash. The total liabilities stand at €3.7 billion, leading to a debt-to-equity ratio of 0.61, which is manageable given the company's cash flow generation.

The company’s current ratio of 1.8 and quick ratio of 1.4 indicate adequate liquidity to meet short-term obligations. The interest coverage ratio of 5.6 demonstrates the company's ability to comfortably service its debt. Additionally, the leverage ratio (Net Debt/EBITDA) of 1.3x points to a conservative financial structure, allowing for future growth investments while mitigating risk.

Puig's prudent financial management, balanced capital allocation, and efficient use of resources position it well for future growth while maintaining stability amidst market fluctuations.

Investment Considerations

Sector Leadership: Puig's position as a global leader in the luxury personal care market provides a solid foundation for continued growth. Its diverse product portfolio across fragrances, fashion, make-up, and skincare allows it to capture a wide range of consumer preferences.

Financial Performance: Consistent revenue growth with a three-year CAGR of 22.8% highlights the company's ability to expand its market presence. Additionally, strong gross, EBITDA, and operating margins reflect effective cost management and profitability.

Valuation Metrics: The current P/E ratio of 16.8x and forward P/E of 15.0x indicate that the market has priced in future growth potential. The EV/EBITDA multiple of 11.1x, decreasing to 10.1x on a forward basis, also supports the view of a fairly valued company within its sector.

Capital Allocation Efficiency: Puig's disciplined approach to capital expenditure and a dividend payout ratio of 35% demonstrate a commitment to balancing growth investments and shareholder returns. The ROE of 14.5% and ROIC of 11.2% underscore the company's efficient use of capital.

Financial Health: A robust balance sheet, with manageable leverage and a healthy cash position, allows Puig to navigate economic uncertainties while pursuing strategic opportunities. Liquidity metrics, including a current ratio of 1.8 and a quick ratio of 1.4, indicate adequate short-term financial flexibility.

Growth Opportunities: Continued international expansion, brand innovation, and strategic acquisitions could drive future revenue growth, supported by strong cash flow generation.

Risk Factors: While Puig’s balance sheet is solid, potential risks include market competition, shifts in consumer preferences, and economic downturns that may affect discretionary spending on luxury personal care products. Maintaining margins while scaling operations remains crucial.

Conclusion

Puig Brands SA has positioned itself as a leader in the luxury personal care market through a diversified portfolio and strategic growth. Its financial performance, marked by consistent revenue growth and robust margins, demonstrates resilience and profitability. With strong cash generation and prudent financial management, Puig is well-prepared to fund expansion and innovation.

A balanced capital allocation strategy and strong financial health support continued expansion while mitigating risks. The company's focus on brand innovation, geographic diversification, and operational efficiency are central to maintaining its competitive edge in a dynamic market environment.

Monitoring Puig’s strategic moves, especially in terms of international growth and product innovation, will provide valuable insights into how the company leverages its strengths to navigate evolving market dynamics and consumer demands.

Important disclaimer:

Data is taken from Finchat.

The content provided in this newsletter is for informational purposes only and should not be construed as financial or investment advice. While I strive for accuracy, some metrics and data presented in these reports may not be entirely accurate or up-to-date. I take no responsibility for any investment decisions made based on the information provided herein.

Investing in the stock market, especially in undiscovered or lesser-known companies, carries inherent risks. The companies discussed in this newsletter may be subject to volatility, liquidity issues, and other factors that could impact their performance.

It is crucial that you conduct your own thorough research and due diligence before making any investment decisions. I strongly recommend consulting with a qualified financial advisor who can provide personalized advice based on your individual financial situation, risk tolerance, and investment goals.

Remember that past performance is not indicative of future results. The stock market is subject to fluctuations, and the value of investments may go up or down. You should only invest money that you can afford to lose.

By subscribing to and reading this newsletter, you acknowledge that you understand and accept these risks and limitations. You agree that I will not be held liable for any losses or damages resulting from the use of information provided in this newsletter.

Always invest responsibly and within your means. Your financial decisions are ultimately your own responsibility.