FREE DEEP DIVE: Building Japan's Infrastructure Future With Stunning Growth

A diversified development platform delivering 63% revenue growth while transitioning from consulting to asset ownership

Welcome to my Substack, where I delve into the world of truly undiscovered companies from across the globe. Everyone is talking about the same 200-300 stocks, but there are more than 55,000 publicly traded companies in the world. Here, we explore hidden gems in the financial markets that often fly under the radar of mainstream analysts and investors.

🎧 Want to explore more company insights? I’m now releasing free audio overviews — separate from the paid deep dives — designed as engaging, conversational breakdowns of different businesses. It’s a great way to discover new ideas on the go.

Teaser

While global infrastructure investors focus on established REITs and utilities trading at premium valuations, one Tokyo-based company has grown revenue nearly ten-fold in four years while transitioning from traditional consulting to direct ownership of energy, logistics, and hospitality assets.

With operations spanning renewable energy development, apartment hotels, cold storage facilities, and healthcare infrastructure, this firm offers investors concentrated exposure to Japan's infrastructure modernization without the single-sector risks of pure-play alternatives. The business has achieved a 63% three-year revenue CAGR while expanding operating margins from 4.1% to 14.4%, demonstrating operational leverage as asset ownership replaces lower-margin consulting services.

Trading at just 0.3x PEG ratio despite consistent execution across multiple high-growth markets, the valuation suggests limited market recognition of the platform's diversification value. Forward earnings projections indicate 63.9% EPS growth over the next two years, yet the stock trades at 11.7x forward earnings - a significant discount to infrastructure peers.

The fundamentals show a business hitting its operational stride with expanding margins and improving capital efficiency, yet negative free cash flow and elevated leverage reflect the capital-intensive nature of infrastructure development. This creates an asymmetric opportunity for investors willing to accept near-term cash flow volatility in exchange for exposure to Japan's multi-decade infrastructure investment cycle.

Paid content would usually be below this line. If you enjoy the content, feel free to subscribe to gain access to all out deep dives and global discoveries!

Kasumigaseki Capital: Real Estate With Stunning Growth

Executive Summary

Kasumigaseki Capital Co., Ltd. (TSE: 3498) operates as a diversified infrastructure and real estate company that transforms traditional property consulting into a comprehensive development platform. Through its integrated approach spanning renewable energy projects, apartment hotels, logistics facilities, and healthcare infrastructure, the company has positioned itself across multiple high-growth sectors of Japan's evolving economy.

Over the past four years, Kasumigaseki Capital has delivered substantial growth, expanding revenue from ¥8.0B in 2020 to ¥78.6B in 2024, representing a 63% three-year CAGR. The company has successfully diversified from pure consulting into asset-heavy infrastructure development, resulting in expanded scale and operational complexity while maintaining improving profitability metrics.

With a current market cap of ¥139.58B and forward valuation multiples that appear reasonable relative to growth prospects, Kasumigaseki Capital offers investors exposure to Japan's infrastructure modernization and energy transition themes through a single integrated platform.

🎧 Want to explore more company insights? I’m now releasing free audio overviews — separate from the paid deep dives — designed as engaging, conversational breakdowns of different businesses. It’s a great way to discover new ideas on the go.

Business at a Glance

Founded in 2011 and headquartered in Tokyo, Kasumigaseki Capital operates across four complementary business segments that leverage Japan's infrastructure investment cycle:

Real Estate Consulting & Development: The company's foundational business involves comprehensive real estate advisory services, from site acquisition and development planning to asset management and optimization strategies for institutional and corporate clients.

Renewable Energy Infrastructure: Kasumigaseki Capital develops and operates power generation facilities utilizing natural energy sources, including solar, wind, and biomass power plants. This segment benefits from Japan's renewable energy transition and favorable regulatory framework supporting clean energy adoption.

Exhibit 1A. Business segments.

Hospitality Operations: The company develops and operates apartment hotels under the FAV HOTEL brand, targeting the growing demand for extended-stay and hybrid accommodation formats in Japan's evolving tourism and business travel markets.

Logistics & Warehousing: The firm provides specialized logistics infrastructure including cold storage, automated fulfillment centers, and dry warehouses, capitalizing on e-commerce growth and supply chain modernization trends.

Exhibit 1B. Business segments (continued).

This diversified approach allows Kasumigaseki Capital to serve as both a strategic consultant for complex infrastructure projects and a direct owner-operator of income-generating assets across multiple sectors.

Revenue and Earnings Growth

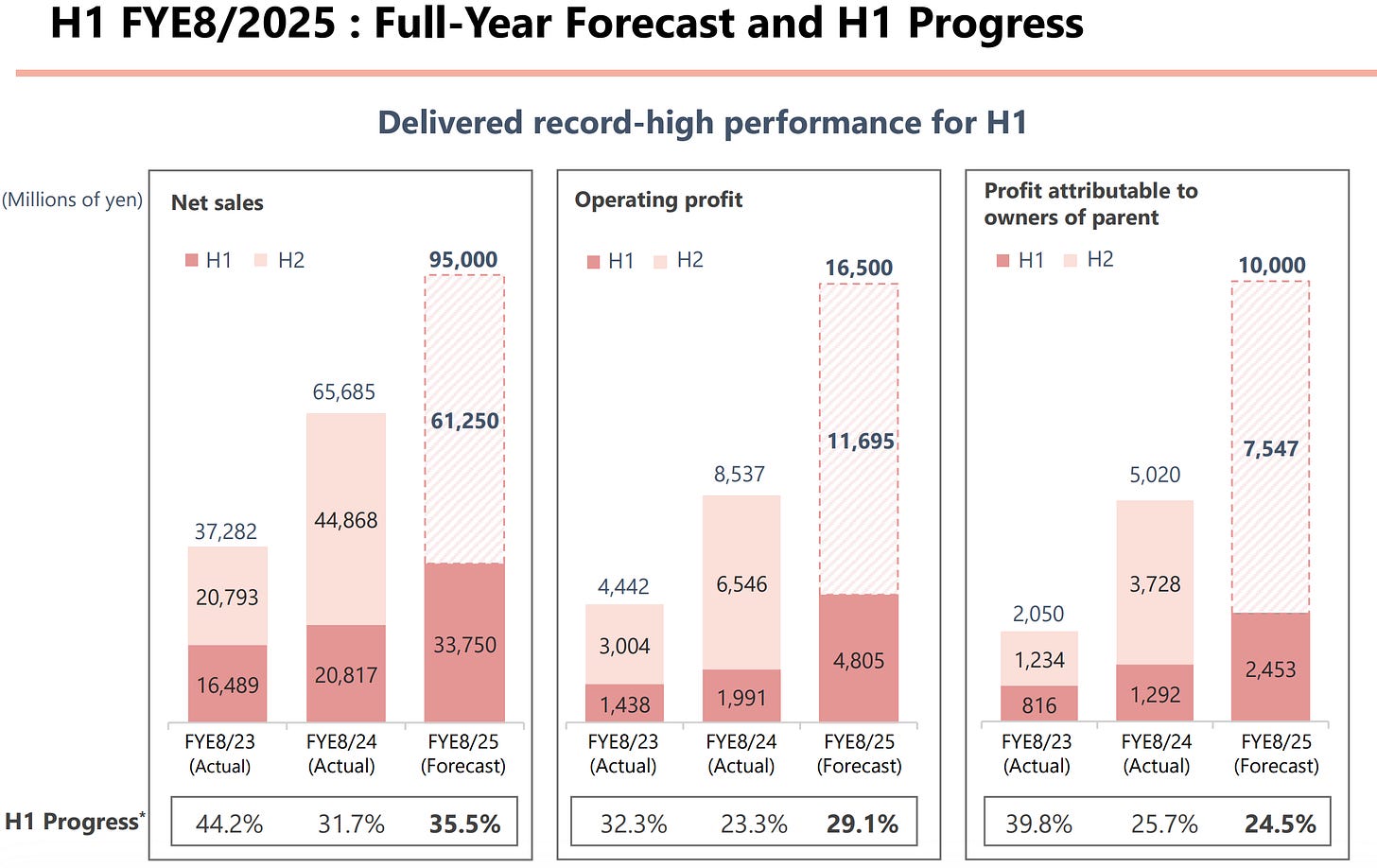

Kasumigaseki Capital's financial performance demonstrates the successful execution of a capital-intensive growth strategy transitioning from services to infrastructure ownership:

Revenue Expansion: The company has achieved substantial top-line growth, expanding from ¥8.0B in August 2020 to ¥78.6B in August 2024, representing a near ten-fold increase over four years. This trajectory includes periods of exceptional growth, with year-over-year increases of 78.5% in 2021, 45.4% in 2022, and 79.4% in 2023, before moderating to 18.2% in 2024 as the business reaches larger scale.

The revenue progression shows clear acceleration through the development cycle: from ¥14.3B in 2021 to ¥20.8B in 2022, then ¥37.3B in 2023, culminating at ¥78.6B in 2024. This pattern reflects the lumpy nature of infrastructure project completions and asset monetization, with revenue recognition occurring as developments reach operational status.

Exhibit 2. Revenue growth and projected growth.

Margin Evolution and Operational Leverage: The transition from consulting to asset ownership has driven significant margin expansion across all profitability metrics. Gross margins have improved from 28.9% in 2020 to 31.5% currently, reflecting the growing contribution of higher-margin asset ownership versus pure consulting services.

Operating margins have strengthened dramatically from 4.1% in 2020 to 14.4% in 2024, while EBITDA margins have expanded from 5.9% to 15.5%, demonstrating substantial operational leverage as the business scales. This margin expansion indicates successful execution of the strategy to move up the value chain from advisory services to direct asset ownership.

Profitability Acceleration: Net margins have increased from 1.7% in 2020 to 7.9% in 2024, indicating successful management of the transition from growth investment to sustainable profitability. The progression shows steady improvement: 5.5% in 2021, 4.9% in 2022, 5.5% in 2023, and 7.6% in 2024, reflecting maturing business operations.

EPS has grown at a 66.4% three-year CAGR, significantly outpacing revenue growth and highlighting improving capital efficiency. The EPS progression from ¥132.8 in 2021 to ¥629.1 in 2024 demonstrates the operating leverage inherent in the infrastructure development model as fixed costs are spread across larger revenue bases.

Forward Growth Trajectory: Consensus estimates suggest continued momentum with 51.8% forward two-year revenue CAGR and 63.9% EPS growth, indicating the business model is entering a more mature but still high-growth phase. EBITDA projections show 93.4% forward growth, suggesting continued margin expansion as the asset base matures and generates more predictable cash flows.

The growth profile reflects the typical infrastructure development cycle, where initial periods require substantial capital investment and show volatile earnings, followed by more stable cash generation as assets reach operational maturity. Kasumigaseki appears to be transitioning into this more stable phase while maintaining substantial growth rates.

Financial Health & Capital Structure

Kasumigaseki Capital maintains a growth-oriented capital structure reflective of its infrastructure development focus:

Balance Sheet Position:

Cash & Equivalents: ¥23.40B

Net Debt Position: ¥41.67B

Debt/Equity Ratio: 2.3x

EBIT/Interest Coverage: 12.0x

The company's capital structure reflects the asset-intensive nature of infrastructure development, with significant debt financing supporting property acquisitions and energy project development. While leverage has increased substantially from previous periods, interest coverage remains adequate and cash balances provide operational flexibility.

Exhibit 3. Assets under management

Working Capital Dynamics: The business demonstrates the working capital intensity typical of development-focused companies, with inventory levels reaching ¥52.8B as of the latest period, representing projects under development and completed assets awaiting monetization.

Cash Flow Characteristics: Operating cash flow has shown volatility, turning negative in recent periods as rapid growth has required substantial working capital investment. Free cash flow has been consistently negative, reflecting the capital-intensive nature of infrastructure development and the company's aggressive expansion strategy.

Capital Efficiency & Operational Metrics

Kasumigaseki Capital's capital efficiency metrics reflect a company managing the transition from consulting services to infrastructure asset ownership:

Return Metrics: Return on Invested Capital has fluctuated between 8-12% over recent periods, indicating moderate efficiency in deploying shareholder capital across infrastructure projects. Return on Equity reached 23.7% in the latest period, while Return on Assets of 7.8% reflects the asset-heavy nature of the business model.

Asset Utilization: Asset turnover of 1.0x demonstrates the company's ability to generate revenue from its substantial asset base, though this metric reflects the capital-intensive characteristics of infrastructure businesses. Fixed Asset Turnover of 16.0x indicates efficient utilization of property, plant, and equipment.

Working Capital Management: Days Sales Outstanding of 7.8 days reflects efficient collection processes, while Days Inventory Outstanding of 307 days aligns with the development cycle timeline for infrastructure projects. The extended inventory conversion period is typical for real estate and energy development businesses.

Operational Efficiency: The company has successfully scaled operations while maintaining operational leverage, with employee productivity improvements evident as revenue per employee has increased substantially during the growth period.

Valuation Analysis

Kasumigaseki Capital presents a complex valuation proposition given its diversified infrastructure exposure and growth trajectory, with current metrics suggesting potential undervaluation relative to growth prospects:

Current Multiples Assessment:

P/E (TTM): 23.0x

P/E (Forward): 11.7x

EV/Sales (TTM): 2.3x

EV/EBITDA (TTM): 14.9x

PEG Ratio: 0.3x

The forward P/E compression from 23.0x to 11.7x reflects expected earnings growth acceleration, with consensus projecting 63.9% EPS growth over the next two years. This creates an attractive entry point for investors willing to accept the execution risk inherent in infrastructure development.

Exhibit 4. Valuation metrics.

The PEG ratio of 0.3x appears particularly compelling for a company projecting continued high growth rates across multiple infrastructure sectors. For context, infrastructure and real estate development companies typically trade at PEG ratios between 0.8-1.5x, suggesting significant valuation discount.

Sector and Historical Context: The EV/Sales multiple of 2.3x appears reasonable for a diversified infrastructure company with recurring revenue elements from energy and hospitality operations. Comparable infrastructure developers in developed markets typically trade at 3-5x EV/Sales, suggesting potential upside as the business model matures.

The EV/EBITDA multiple of 14.9x aligns with infrastructure-focused companies but may not fully capture the value of the development pipeline. As projects transition from development to operational status, this multiple should compress given the higher EBITDA margins typical of mature infrastructure assets.

Valuation Evolution and Trends: Historical valuation multiples show significant compression as the business has scaled. The P/E ratio has decreased from 93.3x in 2019 to 21.6x currently, reflecting both earnings growth and market recognition of business model maturation. Similarly, EV/EBITDA has compressed from 29.5x in 2019 to 14.1x currently.

Exhibit 5. Stock performance over the past 5 years.

This compression pattern suggests the market is beginning to recognize the transition from development-stage to operational-stage cash generation, though current multiples still reflect some skepticism about sustainability of growth rates.

Price Target Analysis and Forward Expectations: Current analyst consensus points to a ¥22,000 price target, suggesting approximately 64% upside from current levels around ¥13,400. The forward valuation compression (P/E dropping from 23.0x to 11.7x) implies the market expects continued operational efficiency improvements to drive earnings growth.

The forward metrics present an attractive risk-reward profile: Forward EV/Sales of 1.4x and Forward EV/EBITDA of 7.6x suggest substantial multiple expansion potential as growth rates stabilize and cash conversion improves. These forward multiples trade at significant discounts to infrastructure peers, creating potential for both earnings growth and multiple expansion.

Risk-Adjusted Valuation Considerations: The negative free cash flow profile and elevated leverage create valuation complexity, as traditional DCF models become challenging to apply. However, the substantial asset base (¥96.4B in total assets) provides underlying value support, with inventory representing ¥52.8B in development projects that should generate future cash flows.

The 1.7% dividend yield provides some downside protection while the company transitions to more stable cash generation. The 19.1% payout ratio indicates conservative dividend policy, preserving capital for growth while providing shareholder returns.

Market Opportunity & Competitive Position

Kasumigaseki Capital operates at the intersection of several structural growth trends in Japan:

Infrastructure Modernization: Japan's aging infrastructure requires substantial capital investment across transportation, energy, and logistics systems. The company's diversified approach positions it to capture opportunities across multiple infrastructure categories.

Energy Transition: Japan's commitment to renewable energy expansion creates sustained demand for solar, wind, and biomass development expertise. Kasumigaseki's established presence in renewable energy development provides exposure to this multi-decade transition.

Exhibit 6. Projected net income (from IR presentation).

Logistics Evolution: E-commerce growth and supply chain modernization drive demand for specialized warehousing and cold storage facilities. The company's logistics segment addresses these evolving requirements.

Tourism Recovery: Japan's tourism sector recovery and evolving accommodation preferences support demand for flexible hospitality formats like apartment hotels.

Competitive Differentiation: Kasumigaseki's integrated platform combining consulting expertise with direct asset ownership creates differentiated value compared to pure-play consulting firms or single-sector infrastructure operators.

Key Investment Considerations

Strengths:

Diversified Growth Model: Multiple infrastructure sectors provide revenue diversification and reduce single-market exposure

Improving Profitability: Expanding margins demonstrate successful transition to higher-value activities

Market Position: Established presence across renewable energy, logistics, and hospitality development

Growth Trajectory: Sustained high revenue growth with improving operational leverage

Potential Risks:

Cash Flow Profile: Negative free cash flow and working capital intensity require continued access to capital markets

Leverage Concerns: Debt levels have increased substantially to fund growth, creating financial risk during market downturns

Capital Intensity: Infrastructure development requires substantial ongoing investment, limiting flexibility

Market Sensitivity: Real estate and energy development sectors face exposure to interest rate and regulatory changes

Execution Risk: Multiple business segments require diverse operational expertise and management attention

Investment Summary

Kasumigaseki Capital represents an opportunity to gain exposure to Japan's infrastructure modernization through a diversified platform combining real estate development, renewable energy, logistics, and hospitality operations. The company has demonstrated strong execution in building scale across multiple infrastructure sectors while improving operational efficiency.

The financial metrics indicate a business successfully transitioning from consulting services to infrastructure asset ownership, with improving margins and strong earnings growth. Current valuation multiples appear reasonable relative to growth prospects, particularly the 0.3x PEG ratio and forward earnings multiple of 11.7x.

Key factors for continued success include maintaining access to capital for growth funding, improving cash flow conversion as projects reach completion, and executing effectively across diverse infrastructure sectors. The company's leverage requires monitoring, though current interest coverage provides adequate cushion.

While cash flow volatility and capital intensity present near-term considerations, Kasumigaseki Capital's positioning across Japan's infrastructure investment cycle and energy transition creates a foundation for sustained growth. The diversified business model provides both growth opportunities and risk mitigation compared to single-sector infrastructure plays.

For investors seeking exposure to Japan's infrastructure evolution through an integrated development platform, Kasumigaseki Capital offers a compelling combination of growth prospects and operational leverage at reasonable valuation multiples.

Important disclaimer:

Data is taken from Fiscal.ai and company website.

The content provided in this newsletter is for informational purposes only and should not be construed as financial or investment advice. While I strive for accuracy, some metrics and data presented in these reports may not be entirely accurate or up-to-date. I take no responsibility for any investment decisions made based on the information provided herein.

Investing in the stock market, especially in undiscovered or lesser-known companies, carries inherent risks. The companies discussed in this newsletter may be subject to volatility, liquidity issues, and other factors that could impact their performance.

It is crucial that you conduct your own thorough research and due diligence before making any investment decisions. I strongly recommend consulting with a qualified financial advisor who can provide personalized advice based on your individual financial situation, risk tolerance, and investment goals.

Remember that past performance is not indicative of future results. The stock market is subject to fluctuations, and the value of investments may go up or down. You should only invest money that you can afford to lose.

By subscribing to and reading this newsletter, you acknowledge that you understand and accept these risks and limitations. You agree that I will not be held liable for any losses or damages resulting from the use of information provided in this newsletter.

Always invest responsibly and within your means. Your financial decisions are ultimately your own responsibility.