FREE Deep Dive: A Global Leader in Kitchen Technology with 50%+ ROIC in 2024

20% net margins, zero debt, and 38% 5-year ROIC — all in a "boring" company most investors have never looked at.

Welcome to my Substack, where I delve into the world of truly undiscovered companies from across the globe. Everyone is talking about the same 200-300 stocks, but there are more than 55,000 publicly traded companies in the world. Here, we explore hidden gems in the financial markets that often fly under the radar of mainstream analysts and investors.

🎧 Want to explore more company insights? I’m now releasing free audio overviews — separate from the paid deep dives — designed as engaging, conversational breakdowns of different businesses. It’s a great way to discover new ideas on the go.

Teaser

While many industrial firms face margin compression and price-driven competition, one German manufacturer continues to demonstrate how engineering excellence and niche dominance can drive durable growth. With over 50% gross margins, 23% return on capital employed, and a global install base exceeding 1.3 million units, this company has quietly become the standard in professional kitchen technology. Yet despite consistent growth and a cash-rich balance sheet, its valuation still lags the quality of the business — offering long-term investors a rare mix of resilience, efficiency, and brand strength in an overlooked industrial vertical.

This is typically where the paywall begins — but we’re making this deep dive free to give you a taste of what paid subscribers receive. Like what you’re reading? Upgrade to get more in your inbox.

RATIONAL AG: Quietly Dominating the World’s Kitchens

Executive Summary

RATIONAL AG is a global leader in professional kitchen cooking systems, offering high-performance combi-steamers and multifunctional cooking platforms used across restaurants, hospitals, schools, and institutional food service. Its focused strategy — centered on engineering precision, premium branding, and global distribution — has allowed the company to dominate a niche market while producing financial results typically associated with top-tier software or consumer franchises.

In FY2023, RATIONAL generated €1.12 billion in revenue, €273 million in EBIT (24.4% margin), and €197 million in free cash flow — converting over 90% of operating income to cash. It maintains gross margins above 50%, a net cash balance sheet (€305M), and delivered ROIC of 23% and ROE of 21% in FY2024. Its products are installed in more than 1.3 million kitchens worldwide, with recurring service and software revenue streams expanding steadily.

Despite premium economics and consistent growth, RATIONAL trades at ~34x earnings and ~25x EBITDA — multiples that may seem elevated until viewed through the lens of capital efficiency, brand strength, and longevity. For investors seeking durable growth and best-in-class industrial returns, RATIONAL combines the resilience of engineering with the economics of a modern platform business.

Want to hear an audio version of my deep dives? It’s not just a read-aloud — it’s a full, conversational overview that brings the insights to life.

Business at a Glance

RATIONAL AG is a German engineering company specializing in thermal food preparation systems for commercial and institutional kitchens. Founded in 1973 and headquartered in Landsberg am Lech, RATIONAL develops, manufactures, and sells intelligent combi-steamers and multifunctional cooking systems designed to replace conventional ovens, grills, pots, and pans in professional settings. The company’s core products — the iCombi Pro, iCombi Classic, and iVario — are used globally in restaurants, hotels, hospitals, schools, military bases, and quick service outlets.

Exhibit 1. Main products (from web page or IR presentation).

What distinguishes RATIONAL is its intense focus on a single mission: to offer the best cooking solutions in the world. Rather than diversifying into adjacent categories, RATIONAL has invested deeply in optimizing its core products and building software, automation, and cloud connectivity (via its ConnectedCooking platform) into its offerings. This disciplined strategy has enabled the company to maintain technological leadership and high switching costs across its 130+ country footprint.

Exhibit 2. Sales by region (from web page or IR presentation).

Approximately 90% of revenue comes from international markets, and sales are supported by a global network of over 1,300 distribution and service partners. The company maintains direct sales organizations in over 30 countries and services over 1.3 million installed units worldwide. RATIONAL’s aftermarket — including service, parts, cleaning products, and accessories — now contributes a meaningful and growing portion of revenue and gross profit, providing recurring revenue streams that complement equipment sales.

The company's culture emphasizes engineering rigor, decentralized responsibility, and long-term relationships — both with customers and employees. With just under 2,500 employees and over 400 patents, RATIONAL maintains a unique combination of SME agility and global industrial reach.

Growth Story & Revenue/Earnings Trajectory

RATIONAL AG has delivered a compelling track record of growth, driven by product innovation, global expansion, and a consistently strong value proposition for professional kitchens. From FY2019 to FY2023, revenue grew from €844 million to €1.12 billion — a 7.2% compound annual growth rate, despite COVID-era disruptions in 2020–2021. More impressively, this topline expansion was achieved without sacrificing margins, capital efficiency, or brand positioning.

Revenue in 2023 grew 10% year-over-year, with strong contributions across regions — particularly in North America (+16%) and Asia (+14%). Europe, still the largest market by volume, delivered mid-single-digit growth. Both of RATIONAL’s core product lines contributed: combi-steamer units (iCombi) accounted for 82% of sales, while the iVario segment continues to grow at double-digit rates, representing ~9% of total sales.

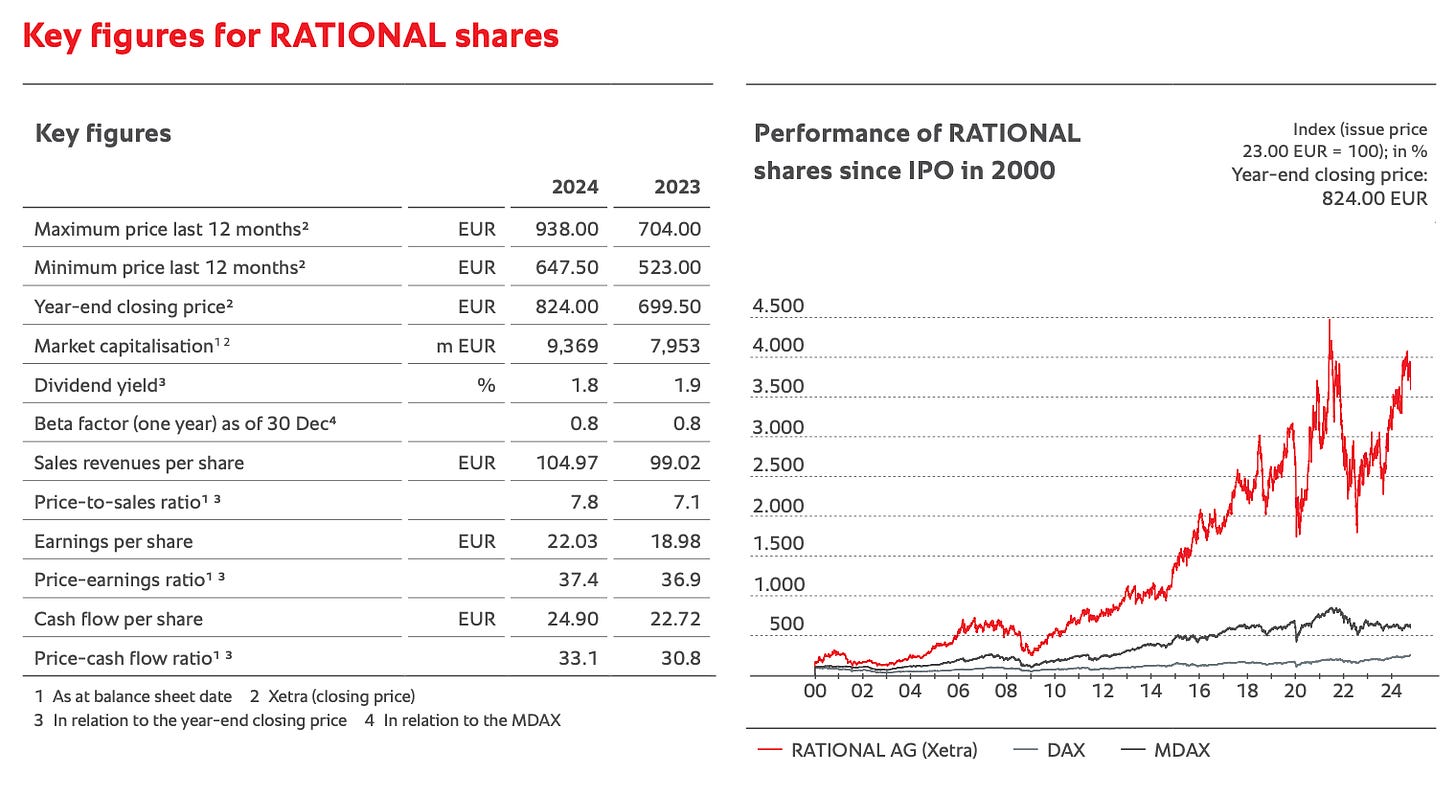

Exhibit 3. Key figures for 2024 (from web page or IR presentation).

Unit volumes increased 9% year-over-year in 2023, with pricing and mix driving another ~1% — highlighting both demand elasticity and the company’s ability to pass on inflationary costs. The global installed base of RATIONAL units surpassed 1.3 million in 2023, further supporting growth in the high-margin service and consumables segment.

Profitability remains a hallmark of the business. Gross profit rose from €470 million in 2022 to €562 million in 2023, with a gross margin of 50.2%. EBIT grew 11% year-over-year to €273 million, with an EBIT margin of 24.4%. Net income came in at €208 million, up 10% vs. the prior year — yielding an EPS of €18.30 per share.

Importantly, RATIONAL’s earnings quality is high: there are few non-operating adjustments, and working capital remains disciplined. Operating cash flow reached €246 million in 2023, up 12% year-over-year, tracking closely with net income. The company’s free cash flow of €197 million provides ample capacity to reinvest in R&D, expand production capacity, and return capital to shareholders — all without drawing on external financing.

In 2024, guidance calls for revenue growth of 7–10%, EBIT margin stability, and continued market share gains in North America and Asia. With a strong order book and expanding recurring revenue from service and software-linked offerings, the near-term outlook remains constructive — and the long-term runway remains substantial.

Margins & Capital Allocation

RATIONAL’s financial model is defined by consistency, efficiency, and discipline — a rare combination in the global capital goods sector. The company’s ability to maintain high margins while scaling across international markets and product categories highlights both the quality of its engineering and the effectiveness of its go-to-market strategy.

Gross margin stood at 50.2% in 2023, slightly up from 49.5% in 2022. This level of gross profitability is exceptional for a company producing physical hardware, and it reflects several structural advantages: proprietary product design, premium pricing power, vertical integration of key components, and a growing stream of revenue from high-margin service, cleaning products, and digital solutions.

Exhibit 4. EBIT margins (from web page or IR presentation).

EBIT margin reached 24.4% in 2023, an improvement from 23.9% the prior year. This margin profile is particularly notable given rising input costs, global wage inflation, and supply chain friction — all of which RATIONAL has managed without resorting to discounting or volume compromises. The margin uplift also suggests successful leverage of operating costs across higher unit volumes and geographic expansion.

On a net basis, net income margin came in at 18.5%, aligning with RATIONAL’s long-term historical average. The company’s margin structure is remarkably stable — and reflects not only operational discipline but also thoughtful R&D spend and SG&A control. R&D investment is consistently ~5–6% of revenue, ensuring continued product innovation without bloating the cost base.

From a capital allocation perspective, RATIONAL is equally methodical. Capex was €49 million in 2023 (about 4.4% of revenue), allocated toward manufacturing upgrades, digital capabilities (ConnectedCooking), and expansion in key growth markets like the U.S. and China. The company expects similar levels of investment in 2024, funded entirely through internal cash flows.

RATIONAL also returns capital to shareholders. The company paid €13.50 per share in dividends in 2023, yielding ~1.8% at current share prices. While not aggressive, the payout reflects a philosophy of rewarding shareholders while retaining flexibility to fund growth. The company has no share buyback program in place — a choice aligned with its conservative approach to cash management and focus on organic reinvestment.

Finally, RATIONAL’s capital deployment reflects long-termism: investments are evaluated for durability and value creation, not short-term margin expansion. This measured approach has led to industry-leading ROCE (23%) and free cash flow conversion above 90% — making it one of the most capital-efficient industrial manufacturers globally.

Financial Health

RATIONAL AG maintains one of the strongest balance sheets in the European industrial sector — an asset-light structure with no financial debt, ample liquidity, and consistently high returns on invested capital. As of year-end 2023, the company reported €305 million in cash and cash equivalents, up from €281 million in 2022, while carrying zero interest-bearing debt. This positions RATIONAL as fully self-financing and resilient across economic cycles.

Exhibit 5. Balance sheet (from web page or IR presentation).

Total assets stood at €1.27 billion, with equity accounting for €994 million — yielding an equity ratio of 78%, a level rarely seen among capital equipment manufacturers. The company’s liability profile is clean and predominantly operational: accounts payable, provisions for warranties and employee benefits, and deferred income tax. There are no complex financing arrangements or contingent liabilities that raise red flags.

Working capital management remains disciplined. Inventories rose modestly to €190 million (vs. €182 million in 2022) to support production scaling and to mitigate supply chain volatility. Receivables increased in line with revenue, maintaining a stable DSO (Days Sales Outstanding), and payables also grew modestly, suggesting consistent cash conversion dynamics. Net working capital as a percentage of revenue remains well under control at ~16%.

Capital expenditure totaled €49 million in 2023, largely allocated toward facility expansions in Germany and China, alongside investments in R&D and ConnectedCooking infrastructure. Even with these outlays, the company generated €197 million in free cash flow, reflecting a conversion rate of over 90% from operating income — reinforcing the asset-light, cash-generative nature of the business.

In terms of financial health, RATIONAL’s return on capital employed (ROCE) was 23% in 2023, with return on equity (ROE) at 21%. These metrics are not the result of leverage but rather of consistent margin performance and disciplined reinvestment. With a capital-light model and a strong backlog of global demand, RATIONAL is well-positioned to deploy capital into long-term, high-IRR projects — or return excess to shareholders.

The company’s financial strength also provides strategic flexibility. RATIONAL can fund M&A, expand capacity, or accelerate global hiring without compromising shareholder returns or taking on debt. In an environment where many industrial peers are capital-constrained, RATIONAL’s fortress balance sheet remains a competitive advantage.

Valuation Analysis

Despite its consistent growth, high returns on capital, and pristine balance sheet, RATIONAL AG trades at valuation multiples that may seem elevated at first glance — but are better understood in context. As of the latest data:

Price-to-Earnings (P/E): ~34x trailing

EV/EBITDA: ~25x

Price-to-Free Cash Flow: ~36x

Dividend Yield: ~1.8%

Enterprise Value / Sales: ~7.3x

These headline multiples place RATIONAL above typical industrial peers — but below consumer-facing compounders with similar margin and return profiles. The company's 23% ROCE, 90%+ FCF conversion, and 50%+ gross margins support a premium valuation. Moreover, RATIONAL has no financial leverage, which implies the company earns its returns through operations rather than balance sheet risk.

Exhibit 6. Valuation metrics (from Finchat).

RATIONAL’s valuation also reflects its position as the global category leader in professional kitchen thermal systems — with high brand equity, durable market share, and an installed base that fuels a growing aftermarket business. As such, the company enjoys quasi-recurring economics without being classified as a traditional software or services business.

When adjusting for net cash (~€305 million), the company's enterprise value to forward EBIT falls below 24x — a level that appears more reasonable given its mid-teens revenue growth, ~24% EBIT margins, and expanding global footprint. On a PEG basis (P/E to EPS growth), RATIONAL trades between 1.7x and 2.0x, depending on earnings assumptions — suggesting a modest premium for a company with top-tier profitability and execution.

Exhibit 7. Stock performance over 10 years (from Finchat).

In terms of peer context:

Global food equipment manufacturers like Middleby or Welbilt typically trade at 14–18x EBITDA, but with far lower margins, higher debt, and more cyclical exposure.

Premium industrial brands such as Halma or Spirax-Sarco trade in similar ranges to RATIONAL, often with lower returns and slower organic growth.

For long-term investors, the valuation reflects not just current cash flows, but the durability and pricing power embedded in RATIONAL’s business model. With a long runway for growth — particularly in the U.S., China, and aftermarket — and continued margin stability, RATIONAL may warrant its premium as a rare mix of industrial hardware, recurring software, and trusted global brand.

Investment Considerations

RATIONAL AG stands out as a rare case of engineering precision meeting financial discipline — a company that dominates its niche globally while maintaining best-in-class profitability and capital efficiency. Its long-term strategy has centered on deep product specialization, a premium brand, and vertical integration, allowing it to build not just superior equipment, but a durable ecosystem around it.

The financials speak to this quality:

Revenue has grown at a steady clip, surpassing €1.1 billion in 2023.

EBIT margins remain north of 24%, even in inflationary environments.

Free cash flow conversion regularly exceeds 90%.

Gross margin is over 50%, an outlier in industrial manufacturing.

And as of FY2024 guidance, RATIONAL is delivering ROIC of 23% and ROE of 21% — without the use of financial leverage.

The company’s balance sheet is fortress-like, with €305 million in cash and no debt. Its capital allocation is both disciplined and conservative: reinvest in product, expand intelligently, and return excess capital via dividends — all while preserving optionality.

Despite these metrics, RATIONAL trades at ~34x trailing earnings and under 8x EV/sales. While this places it at a premium to industrial peers, the multiple is defensible when framed against quality, resilience, and long-term growth potential. The company continues to expand in underpenetrated markets like the U.S. and Asia, while building a growing base of recurring revenue through service, software (ConnectedCooking), and consumables.

In a world where many equipment manufacturers chase volume at the expense of margins or brand integrity, RATIONAL offers a different kind of play: focused, highly profitable, asset-light, and globally respected. For long-term investors looking beyond cyclicality and into compounding industrial franchises, it presents a case that’s difficult to ignore.

Important disclaimer:

Data is taken from Finchat.

The content provided in this newsletter is for informational purposes only and should not be construed as financial or investment advice. While I strive for accuracy, some metrics and data presented in these reports may not be entirely accurate or up-to-date. I take no responsibility for any investment decisions made based on the information provided herein.

Investing in the stock market, especially in undiscovered or lesser-known companies, carries inherent risks. The companies discussed in this newsletter may be subject to volatility, liquidity issues, and other factors that could impact their performance.

It is crucial that you conduct your own thorough research and due diligence before making any investment decisions. I strongly recommend consulting with a qualified financial advisor who can provide personalized advice based on your individual financial situation, risk tolerance, and investment goals.

Remember that past performance is not indicative of future results. The stock market is subject to fluctuations, and the value of investments may go up or down. You should only invest money that you can afford to lose.

By subscribing to and reading this newsletter, you acknowledge that you understand and accept these risks and limitations. You agree that I will not be held liable for any losses or damages resulting from the use of information provided in this newsletter.

Always invest responsibly and within your means. Your financial decisions are ultimately your own responsibility.